Option Greeks are parameters used to measure the sensitivity of an option’s price to changes in various underlying factors, such as the price of the underlying asset, the passage of time, implied volatility, and interest rates.

Here are the details of the most commonly used option Greeks:

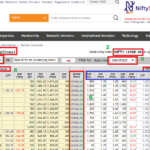

Delta:

Delta measures the sensitivity of an option’s price to changes in the price of the underlying asset. Delta is expressed as a number between 0 and 1 for call options and -1 and 0 for put options. A delta of 0.5 means that for every Rs. 1 increase in the price of the underlying asset, the option’s price will increase by Rs. 0.50 for call options and decrease by Rs. 0.50 for put options.

Gamma:

Gamma measures the rate of change of delta. Gamma indicates the change in delta for a one-point change in the price of the underlying asset. A high gamma means that delta will change more rapidly for a small change in the underlying price.

Vega:

Vega measures the sensitivity of an option’s price to changes in implied volatility. Vega is expressed as the amount that the option’s price will change for a one-point change in implied volatility. A high Vega means that the option’s price will be more sensitive to changes in implied volatility.

Theta:

Theta measures the rate of time decay of an option’s price. Theta is expressed as the amount that the option’s price will change for a one-day decrease in time to expiration. A high theta means that the option’s price will decay more rapidly as time passes.

Rho:

Rho measures the sensitivity of an option’s price to changes in interest rates. Rho is expressed as the amount that the option’s price will change for a one-point change in interest rates. A high Rho means that the option’s price will be more sensitive to changes in interest rates.

Understanding the Greeks is important for option traders, as it allows them to evaluate the risks and potential rewards of a particular option position, and adjust their strategies accordingly to optimize their returns.