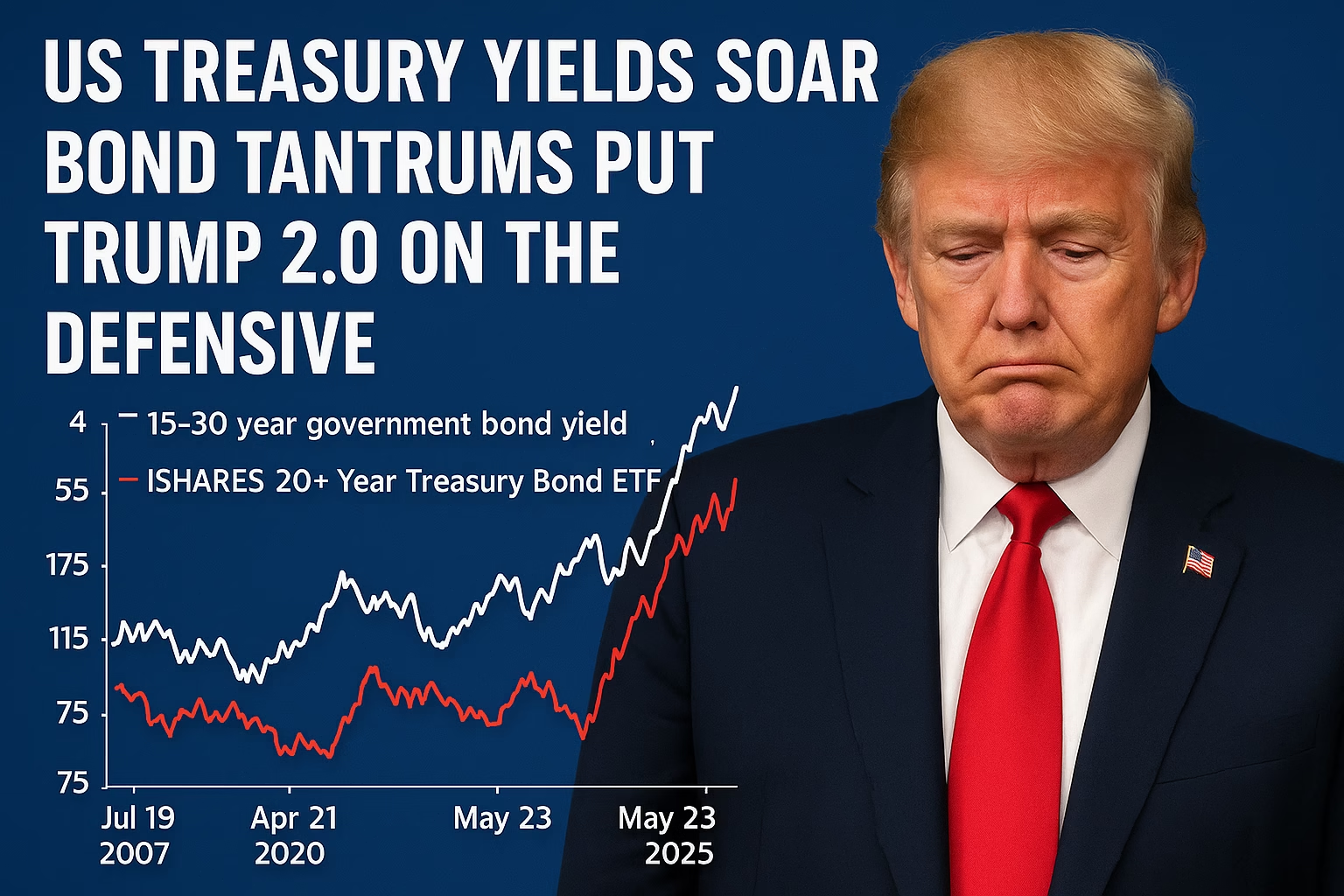

As US Treasury yields surge to their highest levels in nearly two decades, the political and economic playbook of President Donald Trump’s second term is coming under increasing pressure. Investors, economists, and policymakers are watching closely, not just for the numbers — but for what they signal about confidence in U.S. fiscal stability.

Table of Contents

Flip-Flops Amid Bond Market Chaos

In a pattern that’s become all too familiar, President Trump’s policy U-turns seem increasingly timed with dramatic movements in the bond market. Last Friday’s decision to escalate tariffs on the EU — including targeting Apple — came during a week when 30-year Treasury yields hit their highest level since 2007.

This isn’t the first time. Back in April 2025, when 10-year Treasury yields jumped a massive 50 basis points in a week (the biggest move since 2001), Trump abruptly paused reciprocal tariffs for 90 days. These apparent reactions to bond market volatility have earned criticism from market veterans who argue that Trump is letting the bond market dictate policy — or at the very least, signaling panic to investors.

When sovereign bond yields spike, it creates ripple effects across the financial system:

- Higher borrowing costs for consumers and businesses

- Widening fiscal deficits due to increased interest payments

- Pressure on equity valuations, especially in rate-sensitive sectors

Soaring long-term yields are also causing bond investors major pain — the iShares 20+ Year Treasury Bond ETF (TLT) is down a staggering 51%, highlighting the deep losses in “risk-free” assets.

Click on the picture below to Open Demat account with Zerodha

Mixed Signals: Detox or Debt-Fueled Growth?

The Trump 2.0 administration is sending contradictory messages. In early 2025, Treasury Secretary Scott Bessent argued for a “detox” — reducing government spending and letting the economy stabilize. Bond markets applauded.

But in a stark reversal, the administration has since pivoted to pushing “The One Big Beautiful Bill,” focused on tax cuts and a debt ceiling hike — both of which would increase the deficit. Last week, Bessent even claimed that the U.S. would manage its debt not by cutting spending, but by “growing faster than the debt.”

This policy whiplash — “damned if you do, damned if you don’t” — is fueling bond tantrums, and raising the risk of investor revolt.

Global Pressure: Japan, China, and the Yen Carry Trade

While the U.S. bond market grabs headlines, global markets are shaking too. Japan’s 30-year bond yield hit a record high, making Japanese bonds more attractive than U.S. Treasuries — especially as the U.S. dollar weakens.

This could prompt Japanese investors — including their government, the largest foreign holder of U.S. debt — to reduce exposure to U.S. Treasuries. Combined with a weakening dollar, this represents a double whammy for their U.S. bond holdings.

Moreover, a potential unwinding of the Yen carry trade, similar to the August 2024 scare, could introduce more volatility into both currency and bond markets globally.

India: Calm Before the Storm?

Interestingly, Indian bond markets remain an oasis of calm. But that calm is fragile — Foreign Portfolio Investors (FPIs) could quickly turn skittish if global yields stay elevated and capital flows reverse.

In this environment of global uncertainty, gold is likely to remain a favorite hedge, while equities and bonds see-saw with every press conference and yield spike.

US Treasury yields: Key Takeways

US Treasury yields are becoming a key barometer for the global economy and U.S. policy credibility.

Trump’s tariff flip-flops seem increasingly correlated with yield spikes, raising questions of economic strategy vs. political reflex.

Conflicting fiscal messages from the administration are creating policy confusion — and market fear.

Foreign holders of U.S. debt (notably Japan) are under pressure, further increasing the risk of capital flight.

Indian markets may look calm now, but global bond tantrums could spill over.

Disclaimer: Readers to note that the views expressed are for educational purpose. Not meant to be any kind of recommendation for trading / investment. We are not a SEBI registered entity.