For investors looking for a low-risk investment with a fixed return, investing in Treasury Bills (T-bills) can be a great option. T-bills are issued by RBI on behalf of the central government and are backed by its full faith and credit. These securities are issued at a discount to face value and mature at face value.

Table of Contents

Why RBI is issuing Treasury Bills

Treasury bills serve two main purposes.

Treasury Bills are used by RBI to regulate the total money supply in an economy. They are also issued to raise funds required for use by the Government of India. When the economy is booming, high-value treasury bills are issued to the public, reducing money supply in the economy and curbing demand and high prices that hurt the poor. During a recession, the RBI reduces treasury bill circulation and their discounted value. This disincentivizes individuals from investing in treasury bills and encourages investment in the stock market thus positively impacting the GDP and aggregate demand levels in the economy. RBI undertakes these activities under what is known as Open Market Operations (OMO).

The Treasury Bills help the government in raising funds to meet shortfalls in its annual revenue thus reducing total fiscal deficit.

In this article, we will discuss the types of T-bills, their advantages and disadvantages, and where to buy T-bills in the India.

Types of T-bills

In India, there are three types of T-bills basis their maturity periods. :

- 91-day T-bills

- 182-day T-bills

- 364-day T-bills

As mentioned above, these T-bills are issued at a discount to face value and mature at face value.

Advantages of T-bills

- Low-risk investment: T-bills are backed by the central government. This makes them one of the safest investment options available. There is very little risk of default as the government guarantees repayment.

- Fixed return: T-bills offer a fixed return, which makes them a predictable investment option. This can be particularly useful for investors who are looking for a steady stream of income.

Disadvantages of T-bills

- Low returns: T-bills offer a low rate of return compared to other investment options such as stocks, mutual funds, or corporate bonds.

- Short-term investment: T-bills have a short maturity period, which means that investors may need to reinvest their money frequently.

- Inflation risk: T-bills are subject to inflation risk, which means that their value can be eroded over time due to inflation.

Calculate Yield for T-bills

Yield %= (100-P)/P x 365/T x 100

P = Discounted price at which the T-bill is purchased

T = Tenure of the bill

For example, you bought a 182-day Treasury bill from RBI at a discounted value of Rs. 96 while the face value of the bill is Rs. 100, the return (yield) can be calculated as below:

Yield % = (100 – 96)/96 x 365/182 x 100

= 8.35%

Where can you buy Treasury Bills

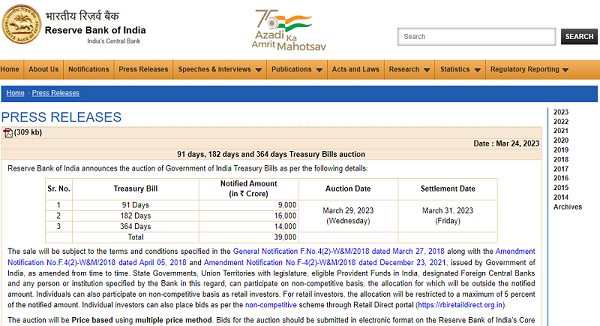

Best way to get the Treasury Bills is to buy directly from the RBI. Under “RBI Retail Direct Scheme”, Individual investors can place bids as per the non-competitive scheme through Retail Direct portal https://rbiretaildirect.org.in. From the screenshot below, you can notice that there are 3 types of Treasury Bills announced by RBI with an auction date and settlement date. You can access this page using link.

Conclusion

T-Bills can be a good investment option for risk-averse investors who are looking for a low-risk investment with a fixed return. However, investors should also consider the disadvantages of T-bills such as low returns and inflation risk.

Also read for other investment options: Fixed Deposit