Table of Contents

Hindustan Aeronautics share – About

Hindustan Aeronautics is strategically positioned as a dominant supplier of aircrafts, helicopters, engines, avionics, and accessories as well as main provider of maintenance, repair, and overhaul (MRO) services to the Indian defence forces.

There is significant improvement in Hindustan Aeronautics Limited’s (HAL) working capital position with

healthy order inflows (outstanding order book worth Rs. 82,000 crore) as on March 31, 2023. This provides high revenue visibility in the medium to long term, while indicating HAL’s strong competitive and strategic positioning.

Click on the picture below to Open Demat account with Zerodha

Hindustan Aeronautics share – Stock highlights

- Inaugurated state-of-the-art Integrated Cryogenic Engine Manufacturing Facility (ICMF) in Bengaluru. The facility will cater to the entire Rocket Engine Manufacturing under one roof for ISRO.

- Supplied four LM2500 Gas Turbines to power the India’s first indigenously designed and built aircraft carrier INS Vikrant

- Completed the production of 15 Light Combat Helicopters (LCH)

- HAL-L&T consortium bagged Rs 860 crore contract on 5th Sep 2022 for end-to-end realisation of five Polar Satellite Launch Vehicles (PSLV) from the New Space India Limited (NSIL).

- HAL delivered the first set of hardware for Gaganyaan mission (first unmanned mission) as well as the 150th HAL made Satellite Bus-structure to ISRO

- The stock is currently trading almost at its all time high

Hindustan Aeronautics share – Stock Split

The company has recently announced 2-for-1 stock split i.e., for every old share you held, you would receive two new shares with the adjusted lower face value. Here,

- Old face value: Rs. 10

- New face value: Rs. 5

In a stock split, the company increases the number of shares outstanding while simultaneously decreasing the stock’s price per share. This is usually done to make the stock more affordable to a wider range of investors and to improve liquidity.

The stock split will be effective on September 29, 2023.

Hindustan Aeronautics share – Financial parameters

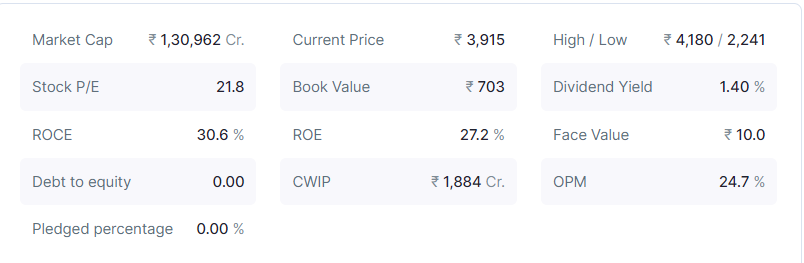

The company’s market capitalization is about ₹1,30,962 Crores. The current stock price stands at ₹3915, with a high/low range of ₹4180 to ₹2241. The stock’s P/E ratio is at 21.8, while the book value is ₹703, and the dividend yield is 1.4%. The company exhibits a robust financial performance with an ROCE of 30.6% and an ROE of 27.2%. With a face value of ₹10.00 and a debt-to-equity ratio of Zero, it maintains a healthy financial structure. Additionally, there is no pledged percentage of shares, highlighting a low level of risk.

Hindustan Aeronautics share – Technical parameters

- PIVOT LEVELS

| Type | R1 | R2 | R3 | PP | S1 | S2 | S3 |

|---|---|---|---|---|---|---|---|

| Classic | 4,045.07 | 4,097.53 | 4,137.57 | 4,005.03 | 3,952.57 | 3,912.53 | 3,860.07 |

| Fibonacci | 4,040.37 | 4,062.20 | 4,097.53 | 4,005.03 | 3,969.70 | 3,947.87 | 3,912.53 |

| Camarilla | 4,001.08 | 4,009.56 | 4,018.04 | 4,005.03 | 3,984.12 | 3,975.64 | 3,967.16 |

Also read: Have a look at the following story:

Disclaimer:

This is not a stock recommendations. All efforts have been made to correctly represent facts and figures in the post. The website or its management is not responsible for any kind of losses arising out of Investing in equities. Investors must therefore exercise due caution while investing or trading in stocks. NSE Options.in or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing