The short strangle (SS) can be a profitable strategy when used correctly, but it also has potential downsides, including unlimited loss potential and the need for careful monitoring of the underlying asset‘s price movements.

Table of Contents

What is a short strangle?

A short strangle is an options trading strategy that involves selling a call option and a put option on the same underlying stock with different strike prices. This strategy is used when an investor expects the stock price to remain relatively stable and wants to profit from the premiums received from selling the options.

Example of Short strangle

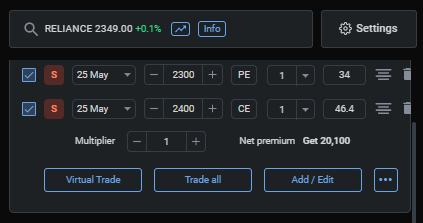

To illustrate how an SS works in the Indian context, let’s consider an example. Assume that Reliance Industries is currently trading at Rs. 2,350, and an investor expects the stock to remain between Rs. 2,300 and Rs. 2,400 over the next month. The investor could sell a call option with a strike price of Rs. 2,400 and a put option with a strike price of Rs. 2,300.

Below is the snippet from the strategy where one lot of Put (PE) @ 2300 strike price and one lot of Call (CE) @ 2400 strike price are sold for a premium of Rs. 34 and Rs. 46.4. Lot size of Reliance is 250 currently.

Payoff chart of SS

Payoff chart for the SS looks like a tent house.

As can be seen from the snippet below, max profit is Rs. 20,100 which is the total premium received for selling the Put and Call simultaneously.

Max profit = (Put premium + Call premium) * lot size

Therefore, (34 + 46.4) * 250 = Rs. 20,100.

Break-even points of Short Strangle

Upper break-even point = Call side strike price + (Put premium + Call premium)

= 2400 + (34 + 46.4) = 2480.4

Lower break-even point = Put side strike price + (Put premium + Call premium)

= 2300 + (34 + 46.4) = 2219.6

If Reliance trades between these break-even points by 25th May (expiry period) viz., 2480.4 and 2219.6, the max profit will be Rs. 20,100.

If Reliance trades beyond these break-even points by 25th May (expiry period) viz., 2480.4 and 2219.6, the loss will be unlimited.

Rewards in Short strangle

1. Generates income: SS can generate income from selling call and put options premiums, making it an attractive strategy for investors looking to generate additional income.

2. Flexibility: SS allows for flexibility in terms of strike prices and expiration dates, providing investors with a wide range of possible outcomes and potential profits.

3. Market-neutral: The SS strategy is market-neutral, which means it can be profitable even in a sideways or stable market environment.

Risks in Short Strangle

1. High risk: Although the risk is limited, a short strangle involves a high level of risk if the stock price moves significantly in one direction. The potential losses can be substantial, and it’s essential to have a solid understanding of options trading and risk management techniques.

2. Margin requirements: Selling options requires margin, which can tie up a significant amount of capital. This can limit the number of SS that an investor can place at any given time.

3. Unlimited loss potential: While the risk is limited, the potential for losses is unlimited if the stock price moves significantly in one direction.

4. Monitoring: SS requires monitoring of the underlying stock’s price movements and changes in market volatility to adjust the strategy accordingly.

It’s important to note that an SS involves a high level of risk, as the potential losses can be substantial if the stock price moves significantly in one direction. It’s crucial to have a well-defined exit strategy in place to limit potential losses and maximize profits.

Open an account with the leading Broker in India and start trading Short Strangles