We will discuss what ROC and ROE are and how they can be used to analyze a company’s financial health and investment potential.

Table of Contents

Return on Capital Employed (ROCE)

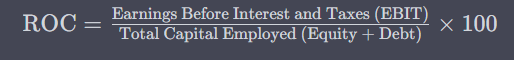

Return on Capital Employed, often abbreviated as ROCE, is a financial metric that measures the efficiency and profitability of a company’s capital investments. It evaluates how well a company is using its capital to generate profits. ROCE is essential because it indicates the return a company earns on the total capital employed, which includes both equity and debt.

Return on Equity (ROE)

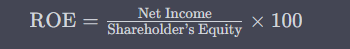

Return on Equity, or ROE, is another critical metric that assesses a company’s profitability, but it focuses solely on the equity portion of the capital structure. ROE helps investors understand how efficiently a company is utilizing shareholder equity to generate profits.

ROCE Vs ROE : Key Differences

Scope of Capital: The primary difference between ROC and ROE is the scope of capital they consider. ROC takes into account both equity and debt, while ROE only considers shareholder equity.

Risk Factor: ROC provides a more comprehensive view of a company’s performance as it includes debt. This makes ROC a more conservative metric, as it considers the risk associated with debt financing. ROE, on the other hand, does not factor in this risk, which can make it seem higher than ROC.

Comparison: ROE is often used by investors to assess a company’s ability to generate profits using only shareholders’ investments. ROC is generally used for comparing companies in the same industry or sector, as it accounts for the different capital structures they might have.

Example for ROCE Vs ROE

Company ABC and XYZ both operate in the same industry. Company ABC has a total capital employed (equity + debt) of ₹500 million and an EBIT of ₹100 million. Its ROCE would be:

ROCE=(100 million/500 million)×100=20%

Company XYZ, on the other hand, has a shareholder’s equity of ₹200 million and a net income of ₹40 million. Its ROE would be:

ROE=(40 million/200 million)×100=20%

In this example, both companies have the same ROE of 20%, but ROCE tells a different story. Company ABC, with its higher ROC, is utilizing both equity and debt more efficiently to generate profits. This indicates that Company ABC might be a better investment choice if you’re considering the risk associated with debt.

Also read: Have a look at the following story:

Disclaimer:

This is not a stock recommendations. All efforts have been made to correctly represent facts and figures in the post. The website or its management is not responsible for any kind of losses arising out of Investing in equities. Investors must therefore exercise due caution while investing or trading in stocks. NSE Options.in or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing