Warren Buffett’s selling of Paytm stock in the Indian market at a loss indeed drew attention due to his status as an investing luminary. His decision to sell Paytm shares resulted in an estimated loss of around Rs 500 crores. The shares were sold for a total of Rs 1370 crore, at a price of Rs 877 per share.

Table of Contents

Buffet’s investment in Paytm stock

Buffett’s investment in Paytm started around 2018, during a stock split in the company. The average buying price was approximately ₹10 per share, amounting to a total investment of Rs 2180 crore. When Paytm went public (IPO), Buffett sold about 14 lakh shares for Rs 300 crore when the stock was priced at Rs 2150.

However, the subsequent selling of the remaining shares led to a considerable loss for Buffett. He sold the remaining shares for Rs 1370 crore, marking a negative return of around 23% or a loss of Rs 510 crores from his initial investment of Rs 2180 crores over five years.

Click on the picture below to Open Demat account with Zerodha

Reasons for Buffet’s exit from Paytm stock

This move by Buffett highlights that even renowned investors are susceptible to losses. There are several potential reasons behind this:

Valuation Concerns: Buffett’s investment philosophy primarily focuses on companies with strong fundamentals and reasonable valuations. If he sold Paytm shares at a loss, it might suggest concerns about Paytm’s valuation being overpriced relative to its fundamental value.

Market Sentiment: Investor sentiment and market dynamics also play a crucial role. Paytm’s market performance might not have aligned with Buffett’s expectations, prompting him to divest from the company.

Learning for Retail Investors: The key lesson for retail investors is the importance of conducting thorough research and understanding a company’s fundamentals before investing. Additionally, paying attention to valuations and not just following renowned investors blindly is crucial.

Accepting Mistakes: Buffett is known for acknowledging his mistakes openly. This transparency and humility in admitting errors can serve as a lesson for investors—learning from failures is an integral part of investing.

Also read: Have a look at the following story

Paytm share price review

Business overview

One97 Communications Ltd., established in 2000, is a prominent player in India’s digital ecosystem catering to both consumers and merchants. The company has a vast customer base, boasting over 333 million clients, and serves more than 21 million registered merchants. One97 Communications Ltd. provides an array of service such as digital wallets, online payment gateways, financial services such as loans, insurance, or investment options, e-commerce platform or tools and services designed to assist merchants in their sales and operations, cloud-based solutions, including storage, computing, or software services delivered over the internet.

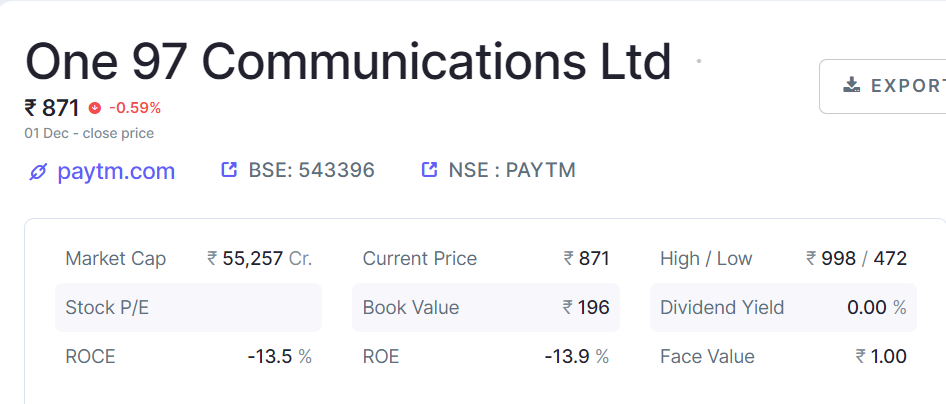

Fundamental parameters of Paytm stock

- Market Cap: This indicates the market value of Paytm’s outstanding shares, currently standing at ₹55,257 Crores, showing the company’s total value in the stock market.

- Current Price: The most recent Paytm share price in the market is ₹871.

- High / Low: The stock’s 52-week high and low prices stand at ₹998 and ₹472, respectively. This shows the range within which the stock price has fluctuated over the past year.

- Book Value: Paytm’s book value per share is ₹196, indicating the value of the company’s assets per share.

- Dividend Yield: Paytm does not offer a dividend yield, implying that the company may not distribute dividends to its shareholders.

- ROCE (Return on Capital Employed): The ROCE of -13.5% signifies that the company’s profitability from the capital employed is negative, suggesting the company might not be efficiently utilizing its capital.

- ROE (Return on Equity): The ROE of -13.9% indicates that the company is not generating positive returns relative to its shareholders’ equity.

- Face Value: Paytm’s face value per share is ₹1.00, which represents the nominal value of the company’s stock.

Sales & Expenses: Paytm’s sales have seen significant growth over the years, climbing from Rs. 449 crores in March 2016 to Rs. 7,203 crores in the TTM (trailing twelve months) period ending March 2023. The consistent growth in revenue showcases the company’s ability to expand its business and capture a larger market share in the digital payment and services sector. While sales have grown, expenses have also increased substantially. This includes operating expenses, which rose from Rs. 2,169 crores in March 2016 to Rs. 8,264 crores in the TTM ending March 2023. This substantial rise in expenses, exceeding revenue growth, raises concerns about cost management and operational efficiency.

Operating Profit Margin (OPM %): The company has struggled to maintain profitability from its core operations. However, there’s a recent improvement from -63% in March 2021 to -15% in the TTM ending March 2023, indicating potential signs of recovery.

Net Profit and EPS: The company has recorded net losses consistently, with improvements noted in recent periods. However, the EPS (Earnings Per Share) remains negative, indicating the company’s inability to generate positive earnings for its shareholders.

NSE Options.in’s view on Paytm share price

Paytm has shown impressive revenue growth over the years capturing market share and expanding its services. However, continuous negative operating margins and net losses raise concerns about the company’s ability to operate profitably and efficiently manage expenses.

Though recent improvements in operating margins and reduced losses in the TTM period show signs of potential recovery, exit of investors like Warren Buffet at loss is a serious concern for retail investors.

It’s essential to closely monitor the company’s ability to turn around its profitability and manage expenses effectively before considering an investment.

Disclaimer:

The above content provided regarding paytm share price in this web post is for informational purposes only and should not be construed as financial advice. Readers are encouraged to consult with financial professionals before making any significant financial decisions.