Nifty 50 is benchmark index formed by the National Stock Exchange of India (NSE). The NSE selects the 50 companies that will make up the Nifty 50 based on certain criteria.

Table of Contents

Nifty 50 Index formation

Nifty 50 stands for “National Stock Exchange 50”. This is a benchmark Index of NSE and is usually referred to as Nifty. Similar to Nifty from NSE, Bombay Stock Exchange (BSE) has a very popular benchmark Index “Sensex” which comprises of top 30 companies in India.

To be included in the Nifty, a company must be among the top companies listed on the NSE in terms of market capitalization (which is the total value of a company’s shares). The company must also have a listing history of at least six months, and it must have a public float (which is the number of shares available for trading on the stock market) of at least 10%.

So, the Nifty 50 is like a big list of important companies in India, and people use it to keep track of how well the stock market is doing. When the Nifty is going up, it means that people are buying more shares in these big companies and that the stock market is doing well. When it’s going down, it means that people are selling more shares, and the stock market is not doing so well.

Once the NSE has identified the 50 companies that meet these criteria, they are included in the Nifty. The companies are chosen from various sectors, including banking, finance, technology, energy, and others, to provide a diverse representation of the Indian economy.

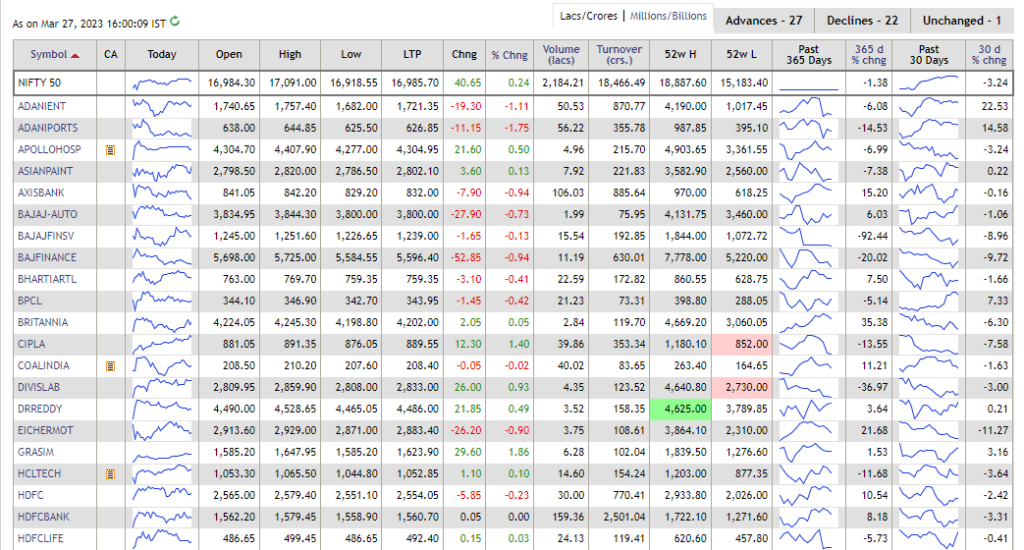

Above picture shows few of the 50 stocks in Nifty. The companies included in the Nifty are periodically reviewed and may be replaced based on their market capitalization and other factors. This ensures that the Nifty always represents the most important and valuable companies in India’s stock market.

Access Full list of Nifty 50 stocks

Weightages of companies in Nifty 50

The weightage of each stock in the Nifty is determined by its free-float market capitalization. Free-float market capitalization is the total value of a company’s shares that are available for trading on the stock market, multiplied by its current market price.

So, the weightage of each stock in the Nifty is proportional to its free-float market capitalization. This means that larger companies with higher market capitalization will have a higher weightage in the index, and their movements will have a greater impact on the overall performance of the Nifty.

Learn more on Free-float market capitalization

Can you buy Nifty 50

Yes, it is possible to buy the Nifty index. There are several ways to invest in the Nifty, depending on your investment preferences and available resources. Here are some common options:

- Exchange Traded Funds (ETFs): ETFs are investment funds that are traded on the stock exchange like individual stocks. There are several ETFs available that track the Nifty index, such as Nifty 50 ETFs offered by various asset management companies. Investors can buy and sell these ETFs on the stock exchange just like stocks.

- Index Funds: Index funds are mutual funds that track a particular stock market index, such as the Nifty. These funds invest in the same stocks that are part of the Nifty in the same proportion as the index, and their returns are linked to the performance of the index.

- Futures and Options: Investors can also trade in Nifty futures and options contracts, which are traded on the National Stock Exchange. These contracts allow investors to take positions on the direction of the Nifty 50 index, either by buying or selling futures or options contracts.

- Directly investing in Nifty 50 stocks: Investors can also buy shares of individual companies that are part of the Nifty, in the same proportion as the index. However, this requires a significant amount of capital and may not be feasible for all investors.

It’s important to note that all investments come with risks, and it’s important to do your own research and consult with a financial advisor before making any investment decisions.

Pingback: What is Free-Float market Capitalization - NSE Options