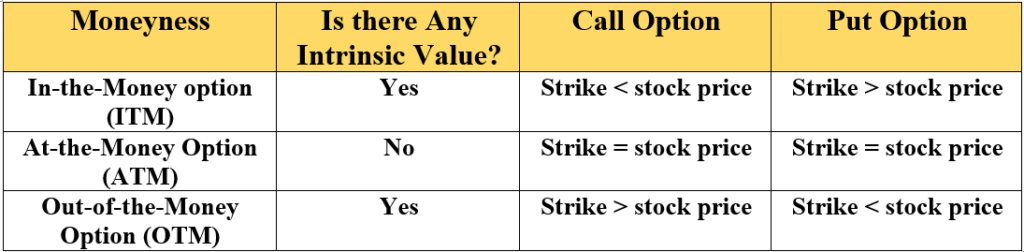

Moneyness of an option refers to the relationship between the current price of the underlying asset and the strike price of the option. An option can be classified as in-the-money (ITM), at-the-money (ATM), or out-of-the-money (OTM) based on its moneyness.

Table of Contents

In-the-Money (ITM) Option – Moneyness of an option

An ITM option is one where the current price of the underlying asset is higher (for a call option) or lower (for a put option) than the option’s strike price. This means that the option has intrinsic value, as it can be exercised profitably. For example, if the current price of a stock is Rs. 1200 and the strike price of a call option is Rs. 1000, the option is ITM.

At-the-Money (ATM) Option – Moneyness of an option

An ATM option is one where the current price of the underlying asset is equal to the option’s strike price. In this case, the option has no intrinsic value, as it would not be profitable to exercise the option. For example, if the current price of a stock is Rs. 1000 and the strike price of a call option is Rs. 1000, the option is ATM.

Out-of-the-Money (OTM) Option – Moneyness of an option

An OTM option is one where the current price of the underlying asset is lower (for a call option) or higher (for a put option) than the option’s strike price. In this case, the option has no intrinsic value and is purely speculative. For example, if the current price of a stock is Rs. 800 and the strike price of a call option is Rs. 1000, the option is OTM.

The moneyness of an option is an important factor to consider when trading options, as it affects the price of the option, the potential profit or loss, and the likelihood of the option being exercised. ITM options are generally more expensive than OTM options, as they have intrinsic value, while OTM options are cheaper but have a lower probability of being exercised.

Exercised here means not about taking delivery or giving delivery of the underlying asset, but about being able to exit the position with a profit / loss.