Founded in 1976, Mangalam Cement Limited is a leading player in the Indian cement manufacturing industry. The company is known for its professional management under the leadership of Smt. Vidula Jalan, a key member of the prestigious B.K. Birla group.

The company boasts state-of-the-art manufacturing facilities located in Morak, Rajasthan, and Aligarh, Uttar Pradesh. The company takes immense pride in offering its high-quality cement products under the renowned brand name, Birla Uttam Cement.

Table of Contents

Mangalam Cement – Business

Sales and Production:

- Highest ever sales and growth of 18% from last year

- Dispatched highest ever PPC cement of 22.17 lakh tons in the year

- Collected more than 2,000 crores and started dispatching maximum quantity from Aligarh unit

- Sold highest ever quantity of 9.66 lakh metric ton out of their capacity of 10 lakhs per quarter in Q4 FY22

Click on the picture below to Open Demat account with Zerodha

Mangalam Cement – Future plans

- Timber business outlook is good and they are producing around 2,200 tons per month

- Realization depends on market-to-market and trade segment has slightly decreased by 5%

- Plans to buy a company to increase capacity

Mangalam Cement – return ratios & valuations

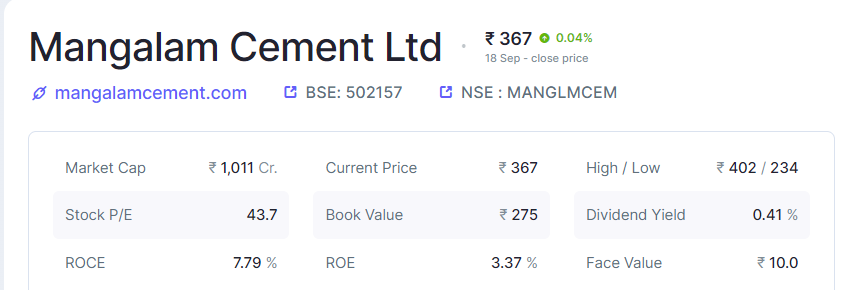

Company is trading at Price multiple of 43.7. Current market cap of the company is about Rs. 1,011 Cr.

Mangalam Cement – Promoters buying

Over this six-year period from March 2017 to June 2023, there is a consistent upward trend in promoter activity. Starting at 13.28% in March 2017, it steadily increases to 34.35% by June 2023. This suggests that whatever is being promoted has been gaining more attention and support over time. Major accumulation by the promoter is thru Vidula Consultancy Services Limited.

Also read: Have a look at the following story:

Disclaimer:

This is not a stock recommendations. All efforts have been made to correctly represent facts and figures in the post. The website or its management is not responsible for any kind of losses arising out of Investing in equities. Investors must therefore exercise due caution while investing or trading in stocks. NSE Options.in or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing