Credit spreads are a type of options trading strategy that involves selling one option and buying another option of the same underlying asset with different strike prices. The objective of this strategy is to earn a net credit while limiting the risk exposure. Credit spreads can be used in a variety of ways to manage risk and generate income.

Table of Contents

There are two main types of credit spreads – the Bull put spread and the Bear call spread.

The Bull put spread is used when the investor believes that the price of the underlying asset will rise or remain stable. On the other hand, the Bear call spread, is used when the investor believes that the price of the underlying asset will fall or remain stable.

So, Let’s take a closer look at each type of credit spread with examples:

Bull Put Spread

A bull put spread is created by selling a put option with a higher strike price and buying a put option with a lower strike price. The goal of this strategy is to earn a net credit while limiting the downside risk.

Example:

Suppose an investor believes that the stock of XYZ Ltd will rise in the near future. The investor can sell a put option with a strike price of Rs. 1000 and buy a put option with a strike price of Rs. 900. If the stock price remains above Rs. 1000, both options will expire worthless and the investor will earn a net credit. However, if the stock price falls below Rs. 900, the investor will incur loss.

Bear Call Spread

A bear call spread is created by selling a call option with a lower strike price and buying a call option with a higher strike price. The goal of this strategy is to earn a net credit while limiting the upside risk.

Example:

Suppose an investor believes that the stock of ABC Ltd will fall in the near future. The investor can sell a call option with a strike price of Rs. 2000 and buy a call option with a strike price of Rs. 2100. If the stock price remains below Rs. 2000, both options will expire worthless and the investor will earn a net credit. However, if the stock price rises above Rs. 2100, the investor will incur loss.

In both cases, the investor can adjust the strike prices and expiration dates based on their risk tolerance and market expectations.

Payoff diagram

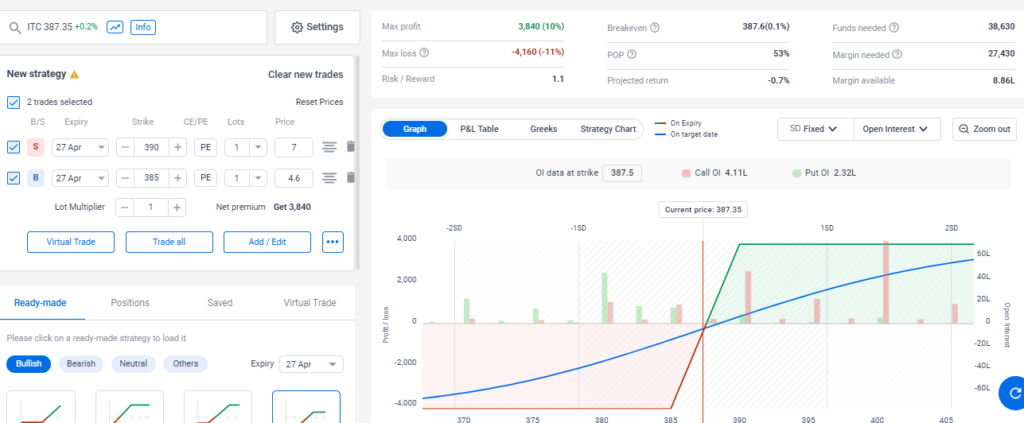

Let us review the a Bull Put Spread in stock: ITC.

ITC is trading in spot market at 387.35. A Bull Put spread can be entered into ITC, if one has a view that ITC does not fall below 390 by the expiry period of 27th Apr 2023.

The following legs can be entered into based on the risk appetite.

Sell one put lot of ITC @ 390 strike price

Buy one put lot of ITC @ 385 strike price as shown in the payoff chart below.

It can be seen that the Max profit in this strategy is Rs. 3840 and max loss is Rs. 4160. Break-even is 387.6. Learn below how break-even point is calculated in a Credit spread.

So, if ITC trades above 387.6 by 27th Apr 2023, you will get a max profit of Rs.3840 and if it trades below 387.6 by 27th Apr 2023, you will face max loss of Rs.4160.

Are credit spreads a good strategy ?

Yes. Credit spreads can be a better strategy than naked option buying for several reasons:

Limited risk:

One of the main advantages of credit spreads is that they come with limited risk. This means that you know exactly how much you could potentially lose upfront, which can help you manage your risk more effectively. In contrast, with naked option buying, your potential losses are unlimited, which can be very risky.

Higher probability of profit:

Another advantage of credit spreads is that they offer a higher probability of profit compared to naked option buying. This is because credit spreads involve selling one option and buying another option at a different strike price. By doing so, you are reducing the amount of premium you need to pay upfront, which can increase your chances of making a profit.

Lower capital requirement:

Credit spreads require a lower amount of capital compared to naked option buying. This is because credit spreads involve selling one option and buying another option at a different strike price, which reduces the amount of premium you need to pay upfront. In contrast, naked option buying requires you to pay the full premium upfront, which can be more capital-intensive. Calculate margin requirements of a Credit spread using this link.

Flexibility:

Credit spreads offer greater flexibility compared to naked option buying. This is because you can adjust your positions as the market conditions change. For example, you can roll your positions to a different expiration date or strike price if the market moves against you.

Time decay:

Credit spreads benefit from time decay, which means that the value of the options will decrease over time. This can work in your favor if you are a seller of the options. In contrast, naked option buying does not benefit from time decay, which can be a disadvantage.

How to calculate break-even point in a Credit spread

Calculating the break-even point is an important step in evaluating the potential outcomes of a credit spread trade and can help you determine the level at which the trade becomes profitable or unprofitable.

To calculate the break-even point in a credit spread, you need to determine the price of the underlying asset at expiration that would result in zero profit or loss for the position. The break-even point can be calculated using the following formula.

For a Bull Put Spread:

Break-even point = Strike price of short put option – Net credit received

Suppose you sell a put option on stock XYZ with a strike price of Rs. 50 for Rs. 3 and buy a put option with a strike price of Rs. 45 for Rs. 1.50. The net credit received is Rs. 1.50. Using the formula above, the break-even point would be:

Break-even point = 50 – 1.50

Break-even point = Rs. 48.50

This means that at expiration, if the price of stock XYZ is above Rs. 48.50, the bull put spread would be profitable. If the price of the stock is below Rs. 48.50, the position would result in a loss.

For a Bear Call Spread:

Break-even point = Strike price of short call option + Net credit received

Here’s an example of how to calculate the break-even point for a bull put spread:

Similarly, here’s an example of how to calculate the break-even point for a bear call spread:

Suppose you sell a call option on stock ABC with a strike price of Rs. 100 for Rs. 4 and buy a call option with a strike price of Rs. 110 for Rs. 1.50. The net credit received is Rs. 2.50. Using the formula above, the break-even point would be:

Break-even point = 100 + 2.50

Break-even point = Rs. 102.50

This means that at expiration, if the price of stock ABC is below Rs. 102.50, the bear call spread would be profitable. If the price of the stock is above Rs. 102.50, the position would result in a loss.