The Suzlon Energy Q4 results for the financial year ending March 31, 2025, have painted a picture of a significant turnaround and robust growth for the renewable energy giant. The company has reported a massive surge in profitability and revenue, signaling a strong comeback and a promising trajectory for the future. This performance underscores Suzlon Energy’s strengthening position in the burgeoning Indian renewable energy sector.

For the fourth quarter of FY25, Suzlon Energy announced a remarkable consolidated net profit of approximately ₹1,181 crore. This represents a staggering year-on-year increase of around 365% compared to the ₹254 crore recorded in the corresponding quarter of the previous fiscal year. This substantial jump in profit was significantly aided by a deferred tax gain. The company’s revenue from operations for Q4 FY25 also witnessed a robust climb, reaching around ₹3,774 crore, a notable 73% increase from the ₹2,179 crore reported in Q4 FY24.

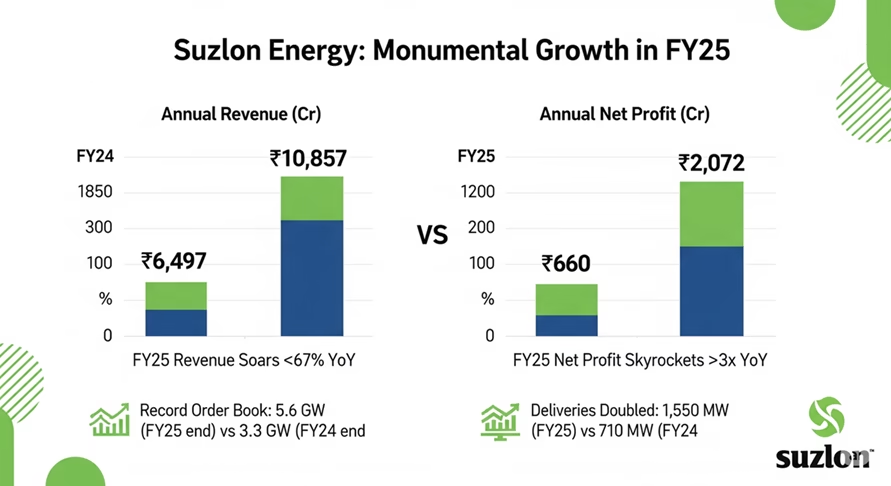

Looking at the full financial year 2024-25, the Suzlon Energy results continued to impress. The company’s consolidated net profit for FY25 soared to ₹2,072 crore, a more than threefold increase from the ₹660 crore achieved in FY24. Annual revenue from operations for FY25 also grew substantially by 67% to ₹10,851 crore, up from ₹6,497 crore in the previous financial year. This strong financial showing highlights a period of sharp operational improvement for Suzlon Energy.

Click on the picture below to Open Demat account with Zerodha

Key operational highlights that contributed to these stellar Suzlon Energy Q4 results include record-breaking wind turbine generator (WTG) deliveries. The company achieved its highest-ever quarterly delivery of 573 MW in Q4 FY25, contributing to a total of 1.55 GW delivered during FY25 – a remarkable 118% year-on-year growth. This improved execution capability is a significant factor in Suzlon’s resurgence.

Further bolstering investor confidence, Suzlon Energy reported a healthy order book, standing at a record 5.6 GW by the end of FY25. The company’s flagship S144 wind turbine series has been a major driver of this success, with its order book alone surpassing 5 GW. This strong order backlog provides excellent revenue visibility for the coming years. The company has also significantly improved its financial health, transitioning to a net cash position of ₹1,943 crore as of March 2025, indicating successful debt reduction efforts.

The Operations and Maintenance Services (OMS) segment of Suzlon Energy also continued its steady performance, managing a substantial portfolio of 15 GW of installed wind energy capacity across India. This segment provides a stable, annuity-based revenue stream for the company.

Management commentary accompanying the Suzlon Energy Q4 results has been overwhelmingly positive. Vice Chairman Girish Tanti remarked that “FY25’s performance sets the stage for Suzlon’s next phase of strategic evolution and market leadership.” He attributed the success to disciplined business transformation and sharp operational focus. CEO JP Chalasani also emphasized the strong foundation laid by these results for future growth, supported by a robust order book and enhanced manufacturing capabilities.

Looking ahead, Suzlon Energy appears well-positioned to capitalize on India’s ambitious renewable energy targets, including the goal of achieving 100 GW of wind power capacity by 2030. The company’s focus on its ‘Make in India’ flagship S144 turbine, expansion of manufacturing capabilities, and a healthier balance sheet are key enablers for sustained growth. While some analysts point to the stock’s significant rally preceding the results and current valuations, the underlying operational improvements and positive industry tailwinds present a compelling case for Suzlon Energy’s continued comeback and expansion in the renewable energy landscape. The Suzlon Energy Q4 results have certainly set a positive tone for the company’s future endeavors.

.

Disclaimer: The information provided in this blog post regarding Suzlon Energy Q4 results is for informational purposes only and should not be considered as financial advice. Investing in the stock market involves risks, and readers are encouraged to conduct their own research or consult with a qualified financial advisor before making any investment decisions. The author and publisher are not responsible for any investment losses incurred