Table of Contents

Olectra Greentech share review – Business

Incorporated in 2000, Olectra Greentech Limited (OGL) is a leading manufacturer of electric buses in India and completed homologation of first E-Bus in 2017. They are manufacturers of the seven-meter, ninemeter and twelve-meter models of the air- conditioned electric buses in India.

Company’s manufacturing facilities located in Hyderabad, with current manufacturing capacity of 1,500 units per year.

Olectra Greentech Limited reported strong growth in both standalone and consolidated revenue and profitability for the year ended March 31, 2023, despite supply chain and macro risks. The company delivered over 1,100-plus electric buses till March 31, 2023. It has also delivered 141 electric buses and 17 electric tippers in Q4.

Click on the picture below to Open Demat account with Zerodha

Olectra Greentech share review – Future plans

Company is setting up new greenfield plant with capacity of 5,000 units/year and scalable upto 10,000 units/year (150 acres land acquired in Hyderabad). It has an order book for 3,394 more buses which the company is expecting to complete within the next 12-18 months.

Company also has plans to enter into new business lines such as Staff Transport private segment and TARMAC buses in Airports.

Olectra Greentech share review – return ratios & valuations

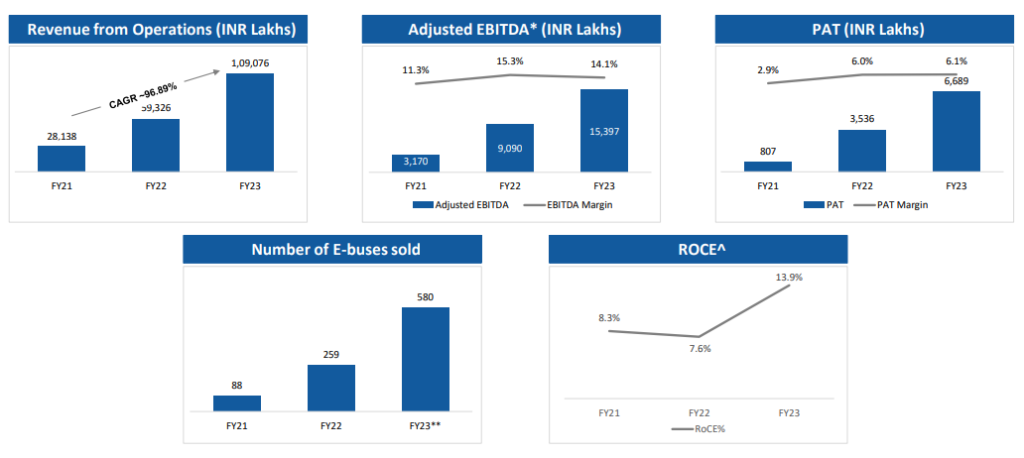

Company regiseted very good CAGR in revenue and profit. Number of buses sold is 2x to 3x every year. ROCE is recording impressive growth. However, company is trading at very high Price multiple of 153. Current market cap of the company is about Rs. 10,200 Cr.

Also read: Have a look at the following story:

Olectra Greentech share review – Risks

OGL has been benefiting from substantial financial support provided by its parent company, Megha Engineering and Infrastructures Limited (MEIL). Over the past five years, OGL has received an infusion of equity amounting to Rs. 660.6 crore from the MEIL group. In the fiscal year 2022, OGL obtained an intercorporate loan from its parent company to finance the acquisition of a designated land parcel for its upcoming plant. It’s important to note that this loan was fully repaid in FY2023.

Looking ahead, OGL has ambitious plans to undertake a capital expenditure (capex) project amounting to approximately Rs. 800 Crore within the next 12 to 15 months. This funding will primarily be sourced through equity or convertible instruments, which can be converted into equity through private placements, including the Qualified Institutional Placement (QIP) route. However, due to current market conditions being less favorable, the company has faced delays in raising the required funds. Nonetheless, OGL is determined to complete the fund-raising process in the coming months.

It is worth emphasizing that the timely completion of this fund-raising effort is a critical aspect that needs close monitoring. Any further delays in securing the necessary funds could potentially impact the company’s expansion plans and its ability to execute its existing order book in a timely manner, as highlighted by ICRA.

While there are good growth prospects due to its order book, execution speed and capex plans, the company is trading very high Price to Earning mutliples. Any downside in the PE or in the earnings due to execution delays or unfavorable market conditions, stock might correct significantly. Investors shall exercise caution.

Disclaimer:

This is not a stock recommendations. All efforts have been made to correctly represent facts and figures in the post. The website or its management is not responsible for any kind of losses arising out of Investing in equities. Investors must therefore exercise due caution while investing or trading in stocks. NSE Options.in or the author are not liable for any losses caused as a result of the decision based on this article. Please consult your investment advisor before investing