In this article, 7 notable differences between European options and American options, are listed and see how Indian market adopted these option types.

Table of Contents

Exercise Date

European options (EO) can only be exercised on their expiration date (option buyer will have to wait until the expiry date for exercising his right), while American options (AO) can be exercised at any time prior to expiration.

Availability

American options are more widely available than European options in most markets.

Price

American options are typically more expensive than European options due to the additional flexibility they offer to the holder.

Dividend Payments

For American options, the holder can exercise the option and capture any dividend payments that occur during the life of the option. However, EOs do not allow the holder to capture any dividend payments that occur after the option is purchased.

Trading Volume

American options tend to have higher trading volumes than European options, as the ability to exercise early provides traders with more flexibility and more opportunities to profit.

Contract Size

American options typically have a larger contract size than European options, which can impact the cost of the option and the amount of underlying asset that the option controls.

Strike Price

American options generally have more strike prices available than European options, which provides more flexibility for traders to tailor their positions to their specific market views.

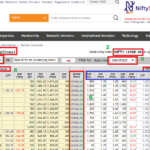

Above details for an option contract can be accessed from official NSE website.

Final word

It is important to note that in Indian context, EOs are settled in cash upon expiration, meaning that if the buyer decides to exercise the option, they will receive a cash settlement equal to the difference between the strike price and the market price of the underlying asset. This type of Options are adopted in the trading of Indices like Nifty, Bank Nifty etc.,

With a little twist, for the stock option contracts in India, require compulsory delivery. If a trader holds an In-the-Money stock option contract at expiry, he/she must give or take delivery of that stock. If stock options remains Out-of-the-money (OTM), they will expire worthless upon expiry and delivery obligation is not imposed.

Also read: How options are priced