A cash Secured Put (CSP) is an options trading strategy that involves selling a put option on a stock that you wouldn’t mind owning at a lower price, while also setting aside enough cash to buy the shares at the strike price if the option is exercised.

Table of Contents

About Cash Secured Put

When you sell a put option, you receive a premium from the buyer of the option. This premium is yours to keep, regardless of whether the option is exercised or not. However, if the option is exercised, you’ll be obligated to buy the underlying stock at the strike price.

To execute a Cash Secured Put, you’ll need to have enough cash on hand to buy the underlying stock at the strike price if the option is exercised. This cash is set aside as collateral, ensuring that you can fulfill your obligation to buy the stock if necessary.

Cash Secured Puts can be a relatively risky way to generate income. If the option is not exercised, you keep the premium and can sell another put option for additional income. If the option is exercised, you’ll acquire the stock at a lower price than the current market value. This helps in potentially providing a nice entry point for a long-term investment.

It’s important to note that selling put options does come with lot of risk, particularly if the stock’s price drops significantly. In that case, you could end up buying the stock at a higher price than its current market value, potentially losing money. Also, the sold Put option will be in deep loss.

How Cash Secured Put works

Let’s say you’re interested in buying shares of Infosys, an Indian multinational information technology company. The current market price of Infosys shares is Rs. 1,421.9 per share, but you think the stock is undervalued and would like to acquire the shares at a lower price.

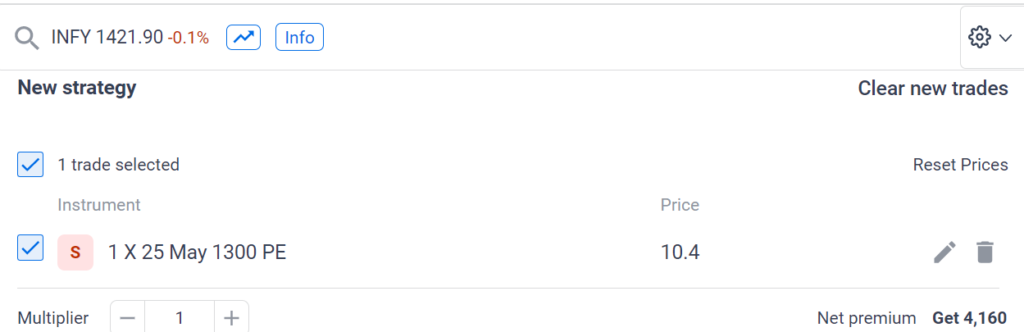

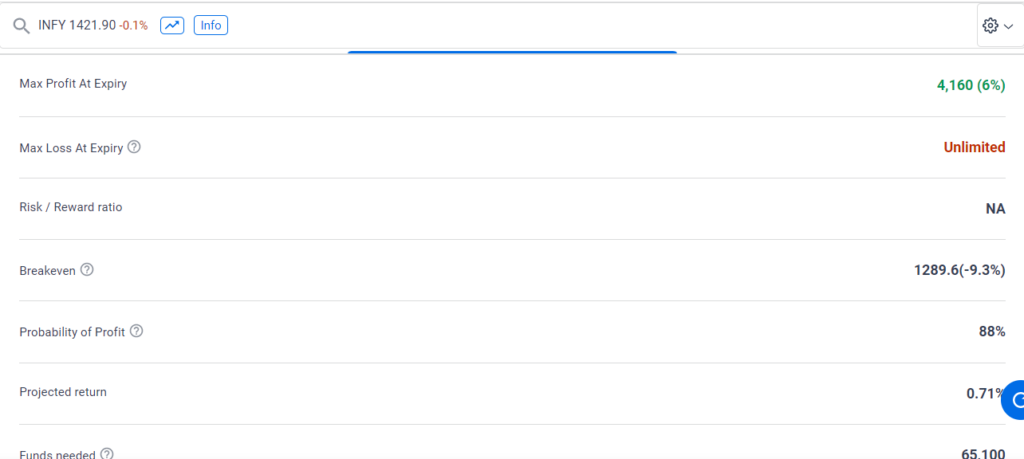

You could sell a put option on Infosys (of 25th May 2023 expiry) with a strike price of Rs. 1,300 and a premium of Rs. 10.4 per share. Lot size of Infosys is 400. By selling this put option, you receive Rs. 4,160 in premium (Rs. 10.4 x 400 shares per contract) upfront.

To execute a Cash Secured Put, you’ll need to set aside enough cash to buy the shares at the strike price if the option is exercised. In this case, you would need to set aside Rs. 5,20,000 (Rs. 1,300 x 400 shares per contract).

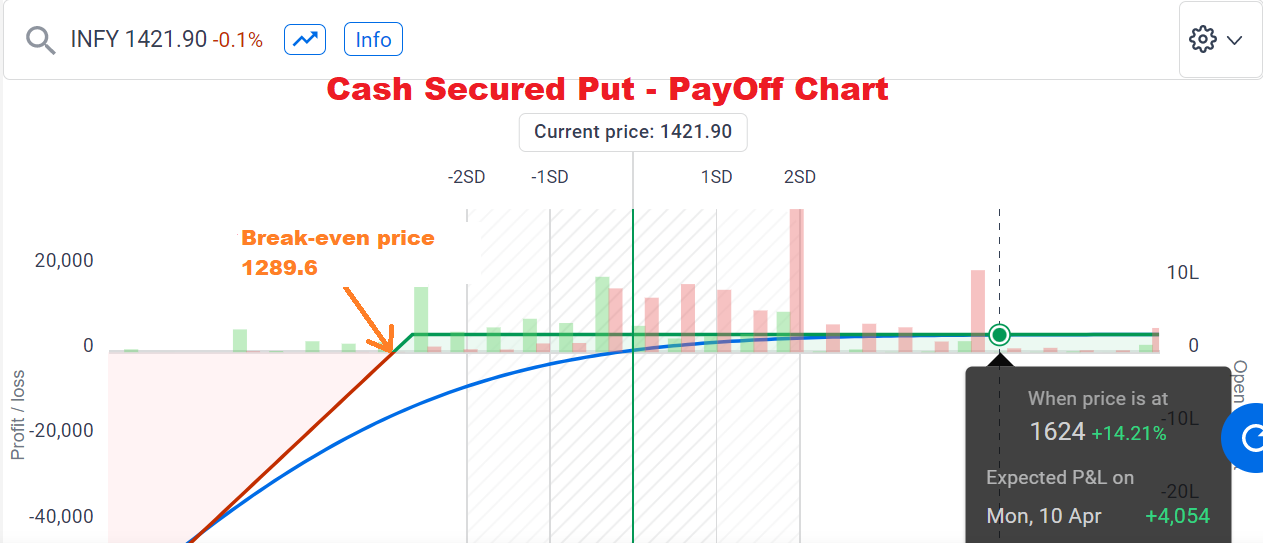

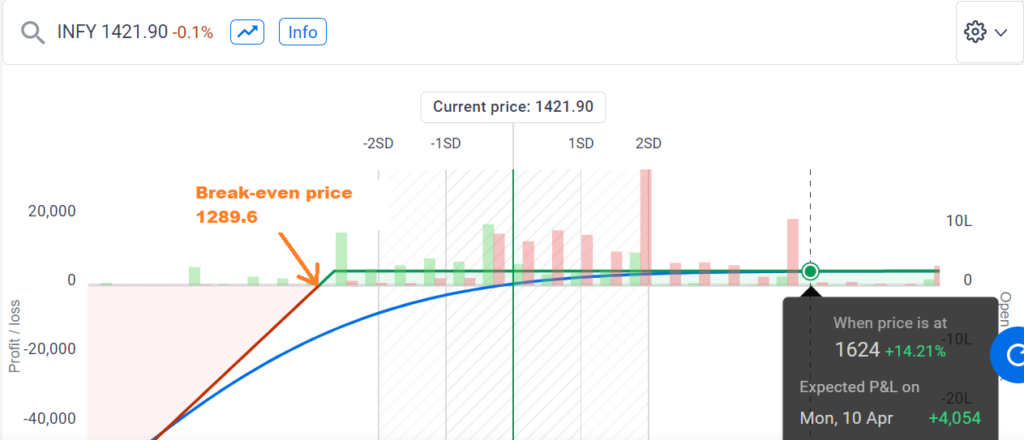

If Infy stays above 1289.6 (break even price) by the end of option expiry date, you keep the premium of Rs.4160. Then, sell another put option of next month. You can keep on doing this every month and generate income.

Strike price of sold option (1300) – Premium received (10.4) = Break-even price (1289.6)

Pay off chart looks like this

If Infy trades below Rs.1289.6 by the end of option expiry date, you’ll acquire the Infosys shares at a lower price of Rs. 1,300 per share (remember! earlier it was trading at Rs.1421.9) , potentially providing a nice entry point for a long-term investment.

Benefits of Cash Secured Puts

Cash Secured Put offers following benefits:

1. Generate income: One of the primary benefits of CSPs is that they can generate income for investors. When you sell a put option, you receive a premium from the buyer of the option. This premium is yours to keep, regardless of whether the option is exercised or not. This can provide a steady stream of income for investors who are willing to sell put options regularly.

2. Lower cost basis: Another benefit of CSPs is that they can allow investors to acquire stocks at a lower cost basis. By selling a put option with a strike price below the current market price of a stock, investors can potentially acquire the stock at a discount if the option is exercised.

3. Reduce risk: Cash-secured puts can also help reduce risk for investors. By setting aside cash to buy the underlying stock if the option is exercised, investors can ensure that they have the funds available to fulfill their obligation. This can help mitigate the risk of losing money if the stock price drops significantly.

4. Flexibility: Cash-secured puts are a flexible strategy that can be used in a variety of market conditions. Whether the market is bullish, bearish, or sideways, investors can use cash-secured puts to generate income and potentially acquire stocks at a lower cost basis.

Drawback of Cash Secured Puts

Some of the drawbacks of cash-secured puts are:

1. Limited profit potential: The premium received from selling a put option is the maximum profit potential for this strategy. If the option is exercised, the profit potential is limited to the difference between the strike price and the stock’s current market price, minus the premium received.

2. Potential for losses: Selling a put option involves the risk of buying the underlying stock at the strike price if the option is exercised. If the stock price drops significantly, the investor could end up buying the stock at a higher price than its current market value, potentially losing money.

3. Opportunity cost: Setting aside cash to buy the underlying stock if the option is exercised means that the investor is tying up their funds and potentially missing out on other investment opportunities.

4. Psychological impact: The potential for losses and the obligation to buy the stock if the option is exercised can create stress and anxiety for some investors.

5. Market risk: The success of cash-secured puts depends on the overall performance of the stock market. If the market experiences a significant downturn, the potential for losses increases.

It’s important to carefully consider the potential drawbacks of cash-secured puts before using this options trading strategy. While it can be a useful tool for generating income and acquiring stocks at a lower cost basis, it’s important to have a thorough understanding of the risks and to carefully manage your portfolio to minimize potential losses.